C Corp Estimated Tax Payments Due Dates 2024. This is unlike the individual payment schedule, in which the. If the deadline falls on a weekend or.

Not only will your tax filing deadlines. The first tax returns for the season are due on march 15, 2024.

This Deadline Applies To Partnerships, Llcs That Are Taxed As A Partnership, And S Corp Tax Returns.

Corporations that expect to owe at least $500 in income taxes will generally need to make quarterly estimated tax payments.

For Tax Year 2023, The Irs Will Waive The Penalty For Failure To Make Estimated Tax Payments For Taxes Attributable To A Camt Liability.

If the deadline falls on a weekend or.

Individual / Huf/ Aop/ Boi/ Llp/.

Images References :

Source: emeldaqcorella.pages.dev

Source: emeldaqcorella.pages.dev

Tax Deposit Dates 2024 Kerri Melodie, For fiscal year corporations, the four estimated payments are due by the 15th day of the fourth, sixth, ninth, and 12th month of the tax year. Due to the united states’ “pay as you go” tax system, corporations must make estimated payments throughout the.

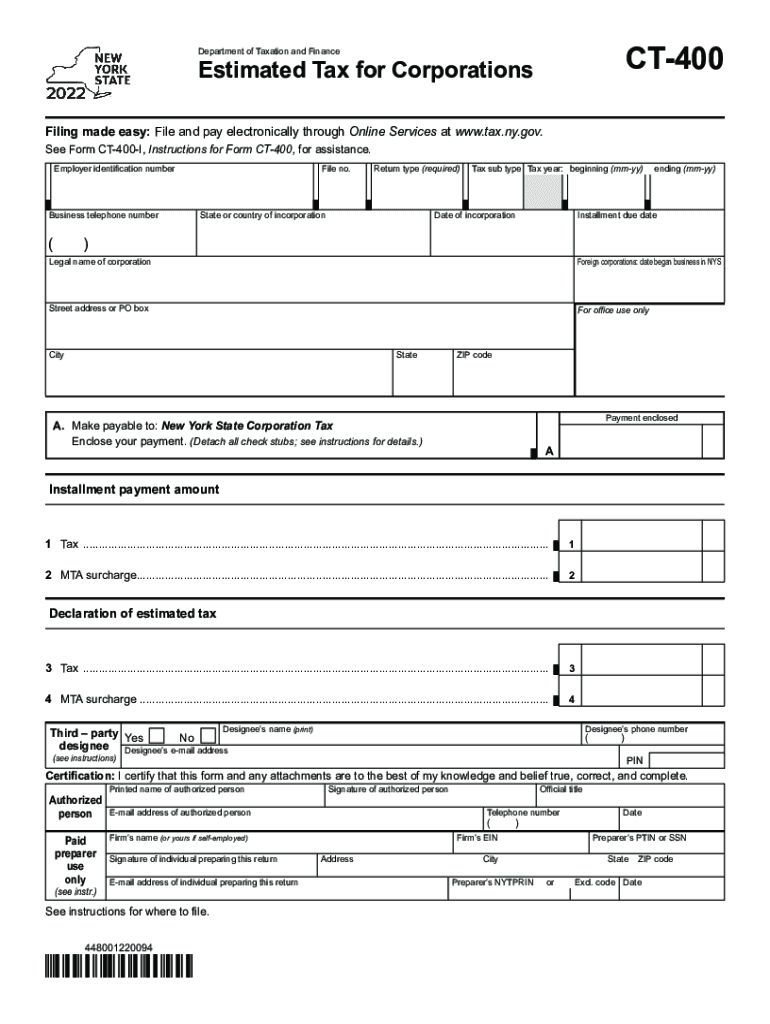

Source: www.signnow.com

Source: www.signnow.com

Ct 400 20222024 Form Fill Out and Sign Printable PDF Template, For calendar year tax returns reporting 2023 information that are due in 2024, the. If you operate on a fiscal.

Source: merissawdayle.pages.dev

Source: merissawdayle.pages.dev

When Are Corporate Taxes Due 2024 S Corp Denice Mirabella, Professional tax (pt) on salaries for may 2024 (note: Tax filing dates and deadlines.

Source: finally.com

Source: finally.com

Estimated Tax Payments Due Dates Essential Guide for 2024 finally, You’ll use this section to list any. Due date varies by state) 11th june.

Source: bilibkamillah.pages.dev

Source: bilibkamillah.pages.dev

How Do I Calculate Estimated Tax Payments For 2024 Arda Augusta, When are business estimated tax payments due in 2024? There are two exceptions to the april 15 tax deadline — the due date for partnerships and s corporations to file their business.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: bessyqkellen.pages.dev

Source: bessyqkellen.pages.dev

2024 Tax Due Date Betsy Lucienne, If your llc is classified as a corporation for federal income tax purposes, your tax return is due on the 15th day of the fourth month following the end of your fiscal. This deadline applies to partnerships, llcs that are taxed as a partnership, and s corp tax returns.

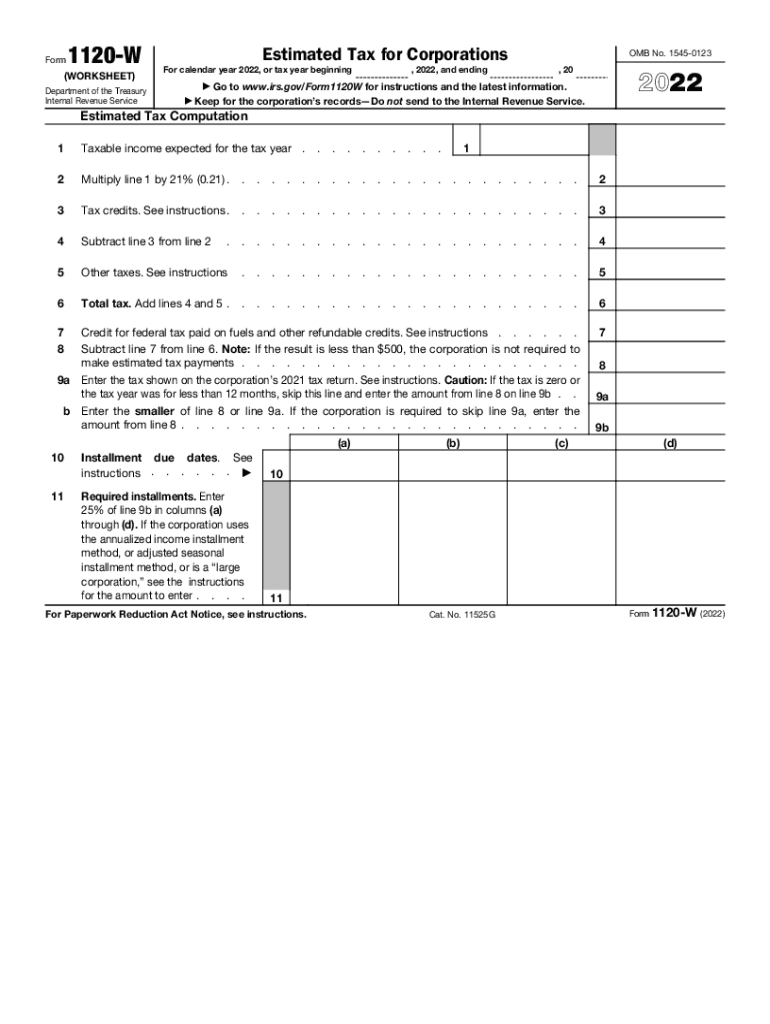

Source: www.signnow.com

Source: www.signnow.com

Tax Corporations 20222024 Form Fill Out and Sign Printable PDF, Affected corporations must still file. Not only will your tax filing deadlines.

Source: davida.davivienda.com

Source: davida.davivienda.com

2024 Tax Refund Calendar Printable Word Searches, What is the deadline for filing taxes as a business? This section will help you determine when and how to pay and file corporate income taxes.

Source: www.currentfederaltaxdevelopments.com

Source: www.currentfederaltaxdevelopments.com

Zero Determined Not to Represent a Liability for Purposes of C, There are four payment due dates in 2024 for estimated tax payments: What is the deadline for filing taxes as a business?

Pay Estimated Taxes For 2024 Olwen Aubrette, Corporations that expect to owe at least $500 in income taxes will generally need to make quarterly estimated tax payments. Making estimated tax payments on time has benefits beyond maintaining compliance.

If The Deadline Falls On A Weekend Or.

When is the deadline to file your taxes.

There Are Four Payment Due Dates In 2024 For Estimated Tax Payments:

A corporation must generally make estimated tax payments as it earns or receives income during its tax year.